Having filed for Chapter 11 bankruptcy protection in October, Sears, once the world’s largest retailer, is down to 223 stores as of last quarter. More recently, Bed Bath & Beyond announced that 40 brick-and-mortar stores will close, the latest struggling legacy retailer to do so — but it won’t be the last. As ecommerce growth continues to explode, UBS analysts project that by 2025, 75,000(!) more retail stores will close, with apparel, electronics and home furnishings being hit especially hard.

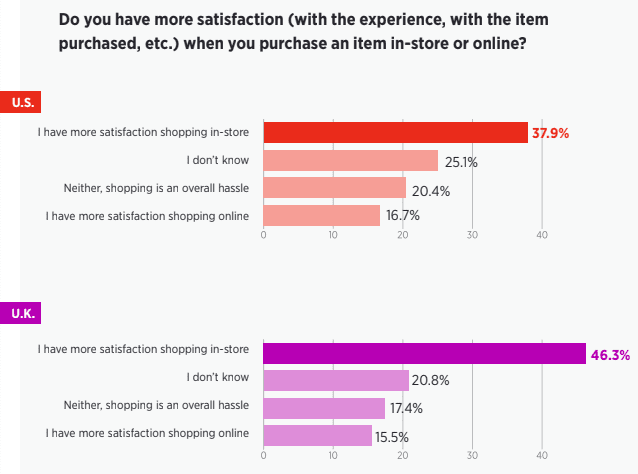

Clearly this means that consumers are collectively over brick-and-mortar shopping, right? When Sailthru surveyed more than 2,000 American and British consumers, we found that most of them didn’t notice or care about the absence of stores like Sears, Toys”R”Us or House of Fraser. However, we also found that people generally prefer shopping in brick-and-mortar stores.

The catch is that consumers favor physical stores that are enhanced by technology. Using digital data to bring personalized customer experiences is challenging, but plenty of retailers are bridging the gap between on- and offline with technology such as beacons, in-store navigation and connected loyalty programs.

Beacons

Beacons allow mobile apps (on both iOS and Android devices) to listen for signals from “beacons” in the physical world. They react accordingly, using Bluetooth Low Energy (BLE) personal area network technology to transmit messages to an app-user passing by. Often, this will be to trigger things like push notifications, app actions, messages, and prompts.

Some of the largest retailers around, such as Walmart, Nordstrom, and Target, are using (or testing) beacon technology to send personalized messages to enhance the brick-and-mortar customer journey. When a shopper visits one of their stores with the brand’s mobile app running on their device, in-store beacons send those customers coupons for products in their shopping carts and messages about items on sale that may be of interest to those customers.

As far as we could tell, big brand beacon use tended to be creatively limited in this fashion. Offering discounts to passersby is the most common implementation. However, even this strategy is challenging. Customers need to have the brand app running on their devices as they move through the store. Moving too quickly also means missing the messages.

There were some bright spots, however. Frank And Oak, a smaller men’s retailer, shows how a more human touch can be applied to beacon technologies. When a high-ranking member of the store’s loyalty program walks into a Frank And Oak store, their mobile app, combined with a beacon, alerts a staff member to offer the customer a freshly brewed cup of coffee.

Rescuing Lost Sales and Loyalty Points

Many retailers use mobile app features to mitigate potentially frustrating in-store experiences, and to ensure that customer sales weren’t lost to limited stock. Abercrombie & Fitch uses mobile technology to help makes sure customers get the sizes they want. The retailer’s mobile app includes a “scan to ship” feature that lets shoppers easily order the proper size if the store doesn’t have it.

DSW also uses its app to better bridge online and in-store. The DSW VIP loyalty program is one of the hallmarks of the brand’s customer experience. When an app user walks into a store, a beacon unlocks rewards and personalized product recommendations from sales associates.

For too long, retailers have considered ecommerce and brick-and-mortar sales to be competing worlds. But it’s abundantly clear that data facilitates the entire customer journey. We hope to see more brands follow the example of these leaders, making shopping more rewarding for both customers and retailers.

Navigating Brick-and-Mortar Stores

Here, retailers were a bit more clever. Both Home Depot and Lowe’sunderstand that contractors and do-it-yourselfers have very different expectations of their stores, and that locating a specific item in their stores, with or without the help of an apron-clad customer service associate, can be a daunting task. Especially once you consider these retailer’s sizes; the average Home Depot store is about 100,000 square feet. For context, a football field is 57,600 square feet.

Both retailers used mobile apps to provide a solution that enhances their brick-and-mortar shopping experiences. A customer can go to the Home Depot website and stock their online shopping cart with the items they need. Then, when the customer enters the store, the mobile app will help find the proper aisle and shelf for those exact items. Lowe’s uses augmented reality to much the same end, with wayfinding features to guide customers.

Mobile Payments

Though the Internet is increasingly a factor, the majority of transactions ultimately still happen in physical stores. Consumers largely prefer shopping in-store, though long checkout lines are a common pain point.

Giving shoppers the ability to pay with their apps is one way around that problem. Brands like Macy’s and Nike are already doing it, with the latter giving loyalty members priority checkout. Walmart is even speeding that up more, with biometric payments.

Proof that shoppers want to see more? The most popular mobile wallet in the U.S. isn’t Apple Pay or Google Pay; it’s Starbucks Rewards.

Learn about Sailthru’s Personalization Marketing Solutions and how they can help you create the best possible experience for your customers.