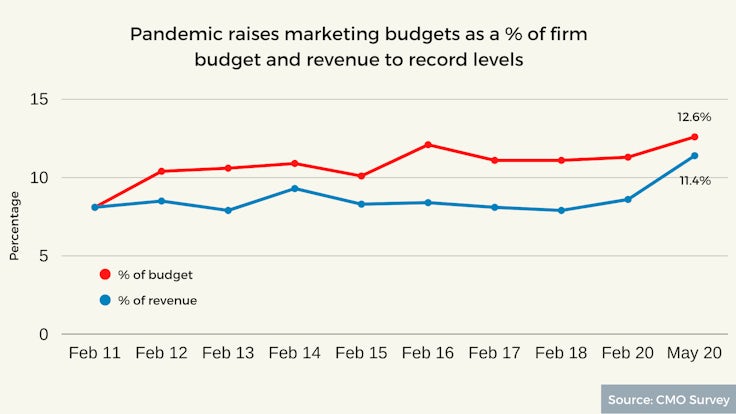

Marketing budgets as a percentage of company revenues and spend have risen to a record high during the coronavirus pandemic as brands turn to marketing to retain customers and build brand value.

Spend on marketing as a percentage of US companies’ overall budgets rose to 12.6% in May, according to the CMO Survey conducted by Duke University’s Fuqua School of Business. That is up from 11.3% in January 2020 and the highest it has been in the 10 years of the survey. The previous high was in January 2016, when it reached 12.1%.

Similarly, spend on marketing as a percentage of a company’s revenues increased to 11.4% in May, well above the 8.6% recorded in January and the previous high of 9.3% in January 2014.

The increases come as marketers’ views on the importance of marketing have increased during the pandemic. Just one in 10 (11.1%) believe marketing has decreased in importance, 26.5% believe there has been no change, while 62.3% believe it has increased in importance.

The increases come as marketers’ views on the importance of marketing have increased during the pandemic. Just one in 10 (11.1%) believe marketing has decreased in importance, 26.5% believe there has been no change, while 62.3% believe it has increased in importance.

The CMO Survey is usually conducted every January and July, but was brought forward this year to capture data about the impact of the coronavirus pandemic.

“Marketing budgets as a percent of revenues and firm budget rose to the highest level in survey history, reflecting the important role that marketing played in helping firms retain customers and build brand value during this difficult time,” Christine Moorman, the survey founder and professor of business administration at Duke University, tells Marketing Week.

“As consumers turned digital, so did marketers’ strategies and they sought to increase digital experiences and improve their companies’ go-to-market digital strategies.”

That shift to digital can be seen in the percentage of marketers’ budgets that is going to social media. Respondents to the survey estimate that 23.2% of their budget was spent on social media in May, almost double the 13.3% in January, which was itself a relatively high number. Marketers also expect this level to be maintained over the next 12 months.

Social media’s contribution to company performance is also up, from 3.4 out of seven (where one is not at all and seven is very highly) in January to 4.2 in May. This may reflect the fact social media was used by 84.2% of respondents for brand awareness and brand building, by 54.3% for retaining customers and by 51.1% for acquiring new customers.

“Marketers believe this strategy has paid off: for the first time in CMO Survey history, the rated contributions of social media to company performance rose. This is an important finding because social media contributions have previously remained flat and at average levels since 2016, despite rising investments,” comments Moorman.

Mobile’s spend as a percentage of marketing budgets also hit 23% in May, up from 13.5% in January, with marketers prioritising mobile web optimisation rather than apps.

Marketers have been following customers with their focus on digital. Some 84.8% of marketers say they have observed their customers being ‘more open’ to digital offerings during the pandemic, while 83.8% say customers are placing increased value on digital experiences.

More than half (59.5%) say their customers have been reviewing, blogging and posting about brands online, while 58.8% have been doing more online research before purchasing.

Many marketers also expect these behaviours to stick in the long-term. A third (33.5%) believe the increased value on digital experiences will remain ‘forever’. There has already been a rise in the percentage of sales coming through digital to 19.3% in May, up from 13.5% in January 2020.

However, two-thirds (67.2%) say there has been a lower likelihood to buy and 43.3% that there is an unwillingness to pay full price. This has resulted in an average 17.8% loss in sales during the pandemic, a 14.7% decline in profits and a 9.2% reduction in customer acquisition.

The percentage of marketers optimistic about the US economy has plummeted to 50.9%, from 62.7% in January and near the record low of 47.7% in January 2009 – during the global financial crash.

Marketers are more optimistic about their own company’s outlook, but again this has dropped to 68.8%, close to the 64.2% in January 2009.