The ongoing coronavirus pandemic is impacting every part of our lives, from the places we can go to the way we spend our time, to the priorities we have and the way we spend our money.

Of course, this has wide-ranging ramifications for marketing, advertising and ecommerce – as well as a number of other sectors like travel, entertainment and FMCG.

To help marketers keep on top of what this means for them, their jobs and their industry, we’re collecting together the most valuable and impactful stats in this roundup, updated on a weekly basis since 20th March.

Read on for statistics on ad revenue, ecommerce usage, grocery spending, TV viewership, social messaging and much, much more.

And to learn more about how the industry is being impacted, join our regular broadcast with marketing thought-leaders, The Lowdown.

Only 14% of UK marketing campaigns are now continuing ‘as planned’

A second survey covering the effects of COVID19 on the marketing industry has been conducted by Econsultancy and Marketing Week, and there have been stark changes in the ways marketers have responded since the first survey was conducted two weeks prior.

As of 31st March, nearly nine in ten (86%) of UK-based marketers are now delaying or reviewing their campaigns, up from 55% on 16th March, leaving just 14% of activations to continue ahead ‘as planned’.

Indeed, the continuing uncertainty has appeared to have had a significant impact on marketing strategies as organisations adapt to changing demands and shift their focus to delivering digital-only products and content. Sixty-two percent of marketers stated that their marketing strategies had changed in light of COVID19 compared to a much smaller 18% in just a matter of weeks. Those altering employee policies (such as remote working, travelling and bonuses) have nearly doubled to 86% and 46% have updated customer policies (such as cancellation terms and fees).

Meanwhile, 85% of organisations have claimed that they are delaying or reviewing new hires, and an even larger 90% are doing the same with their budgeting commitments, rising sharply from 41% and 61% respectively.

The sharp increase in organisations that have decided to change, adapt or pause their marketing and wider business strategies since mid-March paints a clear picture of the increasing toll the coronavirus has taken on the industry. With no end currently in sight, it is likely that marketers will continue making difficult adaptational decisions, causing more disruption to pre-planned campaigns, hires and budgeting.

Marketers are displaying more empathy in a crisis despite downturn in team morale [stats]

69% of UK organisations see demand drop for their products and services

Data from the same Econsultancy and Marketing Week surveys suggests that as many as 69% of UK organisations are experiencing a drop in demand for their products and services.

This figure increases to 77% for SMEs with annual revenue of less than £50m, compared to 64% of big businesses. As a result, it comes as no surprise that smaller companies are often having to make more drastic changes to their hiring plans, budgets and campaigns than their larger counterparts.

In contrast, larger organisations (£50m+) are coming across more supply chain issues than those in smaller companies. Forty-four percent claim that they have experienced an impact to their supply chain, while just 32% of SMEs say the same.

Meanwhile, marketers from all organisations have seen a rise in new requirements for remote working since 16th March, rising modestly from 57% to 72% overall, while there has been a small increase in the number of marketers who claim productivity has been affected by remote working.

Disposable gloves and bread makers among the fastest growing ecommerce categories in the US

Data from Stackline has revealed the fastest growing and declining ecommerce categories in the US.

In March, disposable gloves topped the growth list, showing a 670% rise in ecommerce sales this year when compared to March 2019. Bread machines came a close second at a 652% growth rate, driven by an increase in home baking as panic buyers cause shortages of bread on the shelves of supermarkets.

Other popularly sought out items online include cough and cold products (+535%), long-lasting foodstuffs like soup (+397%) and dried rice (+386%), as well as weight training equipment (+307%) and dishwashing supplies (+275%). While some of these products have seen a surge in demand over recent weeks, it is likely that some will begin to decline in the future as the frequency of high-value purchases (i.e. of home gym equipment) and bulk buying lessen.

In contrast, and perhaps unsurprisingly, suitcases and briefcases ranked as the ecommerce products experiencing the biggest decline, with a 77% drop in sales since March last year. Meanwhile, cameras (-64%), men’s swimwear (-64%) and bridal (-63%) also saw significant downturns as a result of outdoor excursions, holidays and weddings being postponed.

March was the busiest month on record for UK supermarkets, seeing a 20.6% rise in sales

UK supermarkets saw a 20.6% rise in sales during the month of March, a new record for the sector, as consumers stock up for an extended time at home and cease eating out at restaurants. In the four weeks leading to March 31st, the public spent £10.8 billion on groceries – a higher amount even than what is typically spent during the Christmas period.

Extended across the whole of Q1 2020, the grocery market also saw the sharpest year-on-year growth rate in more than a decade at 7.6%.

The week beginning 16th March was an especially busy week for grocery shopping, with as many as 88% of households making an average of five shopping trips to supermarkets between Monday to Thursday. That totals up to around 42 million additional supermarket outings across this relatively short time.

The data from Kantar revealed that the average household has spent an additional £62 on groceries in the past month, and that many more are turning to smaller convenience stores as they heed advice to stay close to home on their ventures out of the house. Indeed, brand-owned and independent corner shops alone experienced a 30% spike in sales in the past four weeks compared to the previous four weeks, enlarging their total share of the grocery market by more than 13%.

It is thought that, as further restrictions are likely to be imposed on movement in the coming weeks and months, that high numbers of journeys to larger supermarkets will begin to decline but smaller, more frequent trips will continue to be taken to local convenience stores.

Global retail email open rates rise by 25% week-on-week

Insight from BounceX suggests that email open rates have risen by up to 25% week-on-week in retail as shoppers remain static at home, meaning a larger amount of time is spent digesting email content. The data also revealed that daily email open rates are generally increasing by 5-10% every week.

Email opens and interactions have increased on desktop since consumers began to work from home on desktop computers and have therefore spent less time checking emails on smartphone devices – an activity typically carried out while commuting or on the move. As a result, those reading email communications on desktop experience a less distracted browsing experience and are taking more time to read longer content. This could pose an opportunity for brands to focus their energy on more meaningful, content-driven messages than snappy CTAs.

While retail sales have undergone a sharp decline across the board in recent weeks, email revenue has remained mostly stable during this period, and in some cases reporting a slight lift. BounceX’s research results have shown a 1.45% rise in conversion rate and 0.4% increase in revenue.

Fashion retail sales drop by up to 41% year-on-year during lowest sales day in March

Sales in the fashion sector have unsurprisingly dropped in most affected areas as brick-and-mortar stores are forced to close and consumers rein in their spending amongst uncertainty around employment and the economy.

However, some countries have been affected more than others. According to research from Nosto, which analysed trends in the Fashion, Apparel & Accessory industry between the 1st and 20th March, France has experienced an especially severe year-on-year decline in sales out of the five regions analysed, with a 41% net drop on its lowest-perfoming day (20th March). The UK came in at second place with a lower drop of 29%, followed by the US at 27%.

Surprisingly, Germany was the only area that experienced some sales growth – 3% to be exact – although this is likely due to brands heavily discounting products, as well as the region’s historical tendency to checkout with a higher average basket value than most of Europe.

While these declining sales figures appear damaging to the industry, overall traffic to fashion websites has experienced a much smaller falloff by comparison, signifying some intent to purchase still remains. This is particularly true for the US market, which saw just a 9% year-on-year decline in traffic against its decline in sales of 27%. As a result, this suggests that consumers, while in fewer numbers than before, are still spending their time browsing such websites and perhaps adding items to their wishlists for a later date.

Since this lowest sales day in March, results have slightly improved across these and other KPIs, and in multiple locations, indicating that retailers have begun to adapt with short-term solutions in order to recover lost sales.

Just Eat traffic falls substantially as UK public claps for carers

A graph shared on Just Eat’s LinkedIn profile demonstrates the scale of the #ClapForOurCarers viral events, the first of which took place on 26th March.

Just Eat disclosed a dramatic drop in traffic to its online platform at 8pm that evening; the same time people all around the UK joined together from the windows of their homes to show their appreciation for the NHS and other key workers by way of applause.

UK retail industry forecast to lose £12.6bn in 2020

A new forecast by GlobalData published on 24th March suggest that UK retail sales are set to dramatically plunge in 2020 due to the coronavirus pandemic.

According to the forecast, the overall UK retail industry will see a loss of £12.6bn this year. Clothing and footwear brands are predicted to suffer the most, seeing a sales decline of 20.6% to £11.1bn. In contrast, the UK food and grocery market is forecast to grow 7.1% in 2020, which is £6.8bn up on the previous forecasted annual spend.

ITV expects at least 10% drop in ad revenue in April

British broadcaster ITV has said that it expects at least a 10% drop in ad revenue during the month of April, according to the Guardian.

Since March, ad revenue for the company has slowed as some brands – particularly in the travel industry – made the decision to pull their advertising until further notice. The drop in March was more severe than originally predicted by expert analysts, leading them to forecast a 10% fall during the coming month.

Originally, ITV had hoped that ad revenue would grow by around 2% in Q1 2020, and some analysts expected an even larger growth of 3.3%, but the continued spread of coronavirus in the UK has knocked these predictions off kilter.

Apart from travel companies halting their marketing efforts, other events like the postponed release of the new Bond film and uncertainty around the European championship football tournament this summer are likely to hit ITV ad revenues even further.

As the UK’s largest commercial broadcaster, it is thought that ITV’s current situation will be mirrored, perhaps more considerably, by smaller ad-reliant broadcasters over the next few months.

Imagery of human interaction declines 27.4% in social ads

A new study by Pattern89, published on 24th March, has noted a shift in the type of imagery brands are using in social media ads since the start of the coronavirus pandemic. Analysing more than 1,100 brands and advertisers active on Facebook and Instagram, Pattern89 found that there are 27.4% fewer images and videos ads of models displaying human interaction (such as hugging or shaking hands).

Since 12th March, imagery featuring people washing hands or faces, and images and videos that display water splashing or cleaning have risen at six times the normal rate. Meanwhile, headline and body copy mentioning “Sports & Fitness” topics has quadrupled (rising from 5.7% to 21% of all ads) since March 12th. Similarly, electronics (such as smartphones or TVs) are now appearing in 39% of social ads.

PR & Communications

47% of global consumers expect companies to support hospitals during the COVID-19 crisis

Forty-seven percent of global consumers now expect companies to support hospitals during the COVID-19 crisis, for example by donating funds or using production facilities to create equipment.

This comes as Kantar releases the second wave of results from its Global COVID-19 Barometer, which details the changing attitudes consumers have had when it comes to brand purpose since the outbreak. Data suggests that the role of companies in wider society has increased, as consumers rely on practical advice, and overwhelmed healthcare centres increasingly rely on donations of money or ‘useful items’.

A further 39%, up by 4 percentage points since wave one, say that brands should make themselves available to assist regional governments where needed.

Almost a third of consumers claim that they want companies to help them or provide advice, such as keeping fit and healthy at home, or tips on how to relax. Depending on how realistic and helpful brands are at this stage could have implications on how favourably or negatively brands will be remembered once the pandemic has ended.

Interestingly, just 8% of consumers think that brand advertising should be suspended during this time, as a large number believe it to be a distraction amongst the onslaught of daily news coverage.

YouTube February watch time soars in several worst-affected countries

New data from YouTube sees a rapid increase in watch time among users in the worst-affected countries throughout February 2020.

The biggest change came from Italy, where there was 20x growth in the amount of content watched from the first to the last day of February. Germany ranked second, experiencing 11x growth during the same period.

Great Britain had a smaller growth in February watch time (6.5x), likely due to having enforced lockdown later than its counterparts in mainland Europe, which experienced the brunt of the pandemic earlier.

Meanwhile, average global daily uploads with titles containing the phrase ‘at home’ rose by more than 50% between March 10th and March 15th when compared to average uploads before 2020. In addition, YouTube recorded a 52% global year-on-year increase in views of ‘study with me’ videos as millions of school-aged users adapt to online learning after mass school closures.

To prevent the spread of misinformation, the platform has increased its policing of content, particularly around the spread of misinformation about the virus, as tens of millions of COVID-19 related search queries are performed on YouTube every day. This Includes the adoption of new information panels which are displayed alongside COVID-19 content or search results.

TV news viewership in China rises by 69% since outbreak began

A study from Nielsen was conducted to investigate the change in media consumption in North Asia as a result of the coronavirus.

TV news viewership in mainland China has risen by 69% in the region since before the outbreak began, as the Chinese public turned in droves to news channels as a reliable source of advice and information relating to the pandemic.

Drama shows were the second most watched genre, seeing a 25% year-on-year increase in viewers, while educational shows saw a moderate 16% increase. TV shopping, on the other hand, experienced a huge year-on-year decline of 65% as consumers tightened their purse strings during economic uncertainty.

Overall time spent watching TV surged by an average of 70 minutes, totalling seven hours and 40 minutes per day as viewers were confined to their homes.

Employment & recruitment

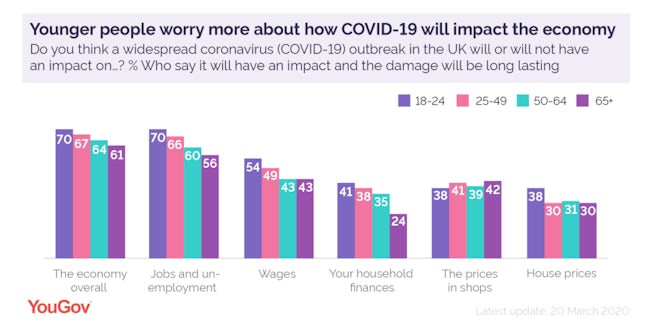

Young people in the UK most worried about impact of coronavirus on jobs and wages

A new study by YouGov has revealed that people aged 18 to 24 are more worried than any other age group about the impact coronavirus will have on the job market in the long-term. According to figures published on 24th March, in a survey of 1,619 adults in the UK, seven in ten 18 to 24-year-olds say they worry that the coronavirus will cause higher unemployment for a long time. This figure drops for every other subsequent age group.

The survey also found that 54% of 18 to 24 year olds believe that coronavirus will affect wages in the long-term, compared with 43% aged 50 and over.

As the pandemic continues to spread, anxiety levels about the economy are rising. The number of people worried that coronavirus will cause long-term unemployment jumped from 26% to 62% in just the space of a week. Similarly, two thirds of Brits now believe there will be lasting damage to the economy, which is up from 36% a week before.

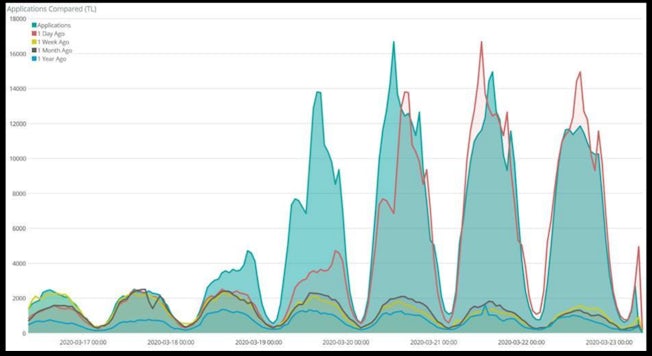

Coronavirus drives surge in job applications to retailers

Retailers have seen their normal rate of job applications skyrocket in the past week or so, with the majority of applications coming from people in the hospitality industry who have just been made redundant.

According to TribePad, the daily rate of applications to retail businesses increased from 5,000 per day to more than 200,000 on Friday 20th March. After supermarkets issued an urgent appeal for staff, Saturday evening saw another big spike, with more than 300 people applying for roles every minute (compared with nine per minute in the previous week).

While hiring activity in the food and grocery sector is on the up, other sectors are seeing a downturn. TribePad data shows that job applications have dropped by 73% in recruitment, 33% in hospitality, and 23% in healthcare compared to the same week in 2019. Meanwhile, organisations in other sectors like fashion retail and hospitality have paused all recruitment activity.

Social media

Activity on Facebook’s messaging apps has increased more than 50% in hardest-hit countries during the past month

In a blog post published on 24th March, Facebook outlined how the coronavirus pandemic has resulted in a surge in usage of its messaging apps.

According to Facebook data, total messaging has increased more than 50% over the last month in many of the countries hit hardest by the virus. Similarly, in places hit hardest, voice and video calling has more than doubled on Messenger and WhatsApp. In Italy, specifically, Facebook has seen 70% more time spent across its apps since the crisis started, while Instagram and Facebook Live views doubled in a week. Messaging in Italy also increased over 50%, and time in group calling (with three or more participants) increased by over 1,000% during the last month.

Despite this, Facebook stated that its business is being adversely affected by coronavirus, in particular its ad platform. This has been echoed by Cowen & Co, which forecasts Facebook ad revenue for 2020 to be $67.8 billion, which marks a drop of $15.7 billion from Cowen’s previous forecast.

45% of global consumers spending more time on social media

A new report by GlobalWebIndex highlights changes in consumer behaviour during the coronavirus pandemic. In a global survey of over 13,000 consumers, conducted between 16th-20th March, GWI found that 95% of consumers are spending more time on in-home media consumption. Unsurprisingly, there’s been a marked increase in watching news coverage, with two in three global consumers spending more time doing this activity.

Across the 13 countries involved in the survey, over 50% are watching more streaming services, 45% are spending more time on messaging services, and almost 45% are devoting more time to social media. Interestingly, over 10% also say they are creating and uploading videos.

Elsewhere, the report notes that views on advertising are polarised. When asked if brands should carry on advertising as normal, just over a third agree, just over a quarter disagree and just over a third aren’t sure. Gen Zs (38%), men (39%) and the higher income group (39%) were the most likely to agree that advertising should continue as normal.

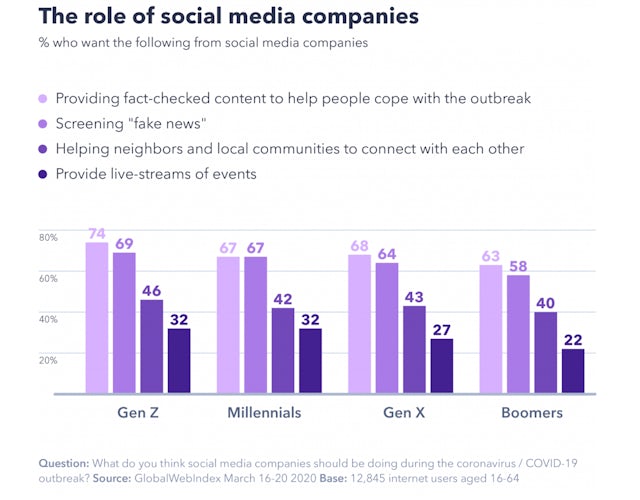

74% of Gen Z want social media platforms to provide fact-checked content about COVID19

Globally, seventy-four percent of Gen Z believe the role of social media companies during the pandemic is to provide fact-checked content about the virus, according to a survey from GlobalWebIndex. A further 67% of Millennials, 68% of Gen Xers and 63% of Boomers agree, making it the most desired feature across platforms since media coverage and misinformation surrounding the virus began to accelerate. Those who use WeChat were the most insistent about their desire for fact-checking.

The screening of fake news by social media companies is the second most popular change users would like to see – across all ages – as conspiracy theories and mass sharing become a more prominent issue. Meanwhile, there is noteworthy interest in ways platforms could be used to help local communities connect with residents to offer assistance during prolonged periods of isolation. Forty to forty-six percent of each age category agreed that they would like to see this feature introduced or improved.

It is clear that much of the global population are missing out on cultural activities outside of the home, as shutdowns of entertainment venues become the norm for the time being. However, it seems as though finding an alternative way to view such events is a lower priority than policing COVID19 related content or helping their local communities. Around one third of Gen Z and Millennial respondents said that they wanted social media companies to provide livestreams of events, dropping to 27% for Gen Xers and 22% for Boomers. When dissected across providers, those who use Snapchat (typically a younger demographic) tend to want livestreams as part of their social experience during the pandemic more than those who use other platforms.

Global Twitter conversations about COVID-19 quadrupled in March

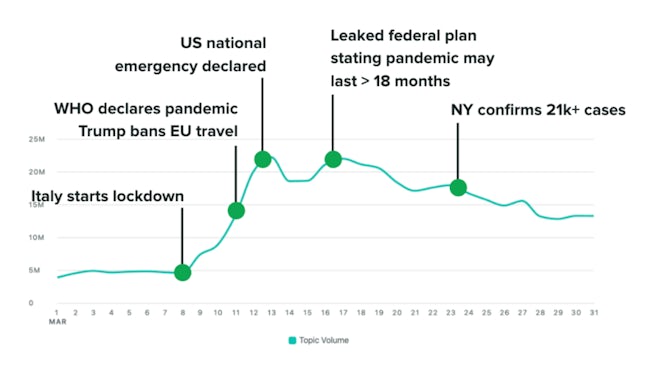

Global Twitter conversations surrounding the coronavirus pandemic quadrupled in the month of March, according to insight from SproutSocial.

The study found that topic volume remained at a steady one million global posts per day during February, but this soon spiked to 5-6 million after the US stock market was hit. Since then, topic volume rose from around 5 million in the first days of March to 20 million as the US declared a state of emergency in mid-March. Subsequently, conversation about the coronavirus has remained between around 13-20 million daily posts worldwide.

While there were whispers about the virus on the platform earlier this year, the topic began to really gain traction around the 20th January, as the first case of COVID19 appeared in the US. Other major timeline events, such as the official quarantining of the city of Wuhan and the WHO declaring the virus’ pandemic status all contributed to the frequency of online conversation.

Since the reality of the situation has sunk in and many households remain indoors and practice social distancing, the types of conversations people have about COVID19 has shifted somewhat. Phrases related to unemployment (up 4725%), social distancing (up 1188%), and homeschooling (up 2111%) have experienced rapid upturns as citizens share the impact the virus has had on their daily lives.

Travel

55% of frequent vacationers ‘may’ or will ‘likely’ book future holidays while confined to their homes during the coronavirus outbreak

Despite an unprecedented number of people cancelling pre-booked holidays and choosing not to travel, it doesn’t mean they haven’t stopped looking at holidays altogether, according to a report from Izea published on 18th March.

In fact, 55% of US consumers who usually travel five or more times per year say they ‘may’ or will ‘likely’ purchase a future holiday while confined to their homes during the coronavirus outbreak. This likelihood rises to 61% for those who travel frequently for business purposes.

The data also reveals how future booking intentions differ depending on how far in the future they are. Thirty-eight percent of US consumers say that they ‘would never buy’ a non-refundable hotel or plane reservation if the required travel date fell within the next 1-4 weeks. The number declines steadily as the number of weeks pass. Once the travel date falls over nine months from now (around Christmastime), just over one-fifth still refuse to make non-refundable bookings but more require increasingly higher discounts of up to 50% in order to be persuaded.

This suggests that consumers will take a while to come back around to the idea of travelling abroad on a non-refundable basis once the coronavirus has died down; certainly longer than a timeframe of nine months. As a result, holiday companies must look to the future and focus on targeting loyal, frequent customers (whether travelling for business or pleasure) who will more likely take the risk sooner than more casual vacationers.

International Air Transport Association predicts drop of $252 billion in air transport revenue during 2020

The International Air Transport Association (IATA) has predicted a drop of $252 billion in air transport revenue during 2020 in light of the coronavirus pandemic and resulting travel restrictions around the world. The figure is 44% down on revenue during 2019 and more than double the IATA’s previous estimate of a $113 billion drop which was published on 5th March.

According to the data, Europe are due to be the hardest hit in terms of revenue, with an expected 46% decline per passenger and kilometre compared to 2019, while Latin America and the Middle East could suffer 41% and 39% dips respectively. This equates to around a $76 billion European, a $19 billion Middle Eastern and a $15 billion Latin American revenue loss in regional air travel markets overall.

While the IATA predict a smaller percentage revenue change in APAC (at a 37% drop per passenger and kilometre), the effect on its total revenue is by far the most destructive. Indeed, an $88 billion loss is anticipated on 2019 revenue figures, $12 billion more than Europe.

IATA’s Director General, Alexandre de Juniac, commented in a press release: “The airline industry faces its gravest crisis. Within a matter of a few weeks, our previous worst case scenario is looking better than our latest estimates.”